owner's draw in quickbooks self employed

As the business owner you need to pay yourself to cover your personal expenses and justify the time you spend working in your. All the income shows being in the bank account of the business but in actual fact theres isnt much in there at all.

How To Pay Invoices Using Owner S Draw

Kimmel Author Donald E.

. This sixteen week online course is. Also recall that self-employed health insurance and Health Savings Accounts HSA add to your Box 1 wages on your W-2. If social media is not included in a marketing campaign businesses non-profits marketing managers and self-employed individuals can quickly find their marketing efforts and campaigns failing to produce the intended results.

Armed Forces icon and one of the worlds top endurance athletes. You have a lot of love for your business but you also know that love doesnt pay your bills. You would pay yourself a 48000 salary but your W-2 Box 1 and Line 7 Officer Compensation on your S corporation tax return would show 60000.

Watch the short video below to get a step-by-step walkthrough. Although sometimes defined as an electronic version of a printed book some e-books exist without a printed equivalent. Paying yourself an owners draw in QuickBooks is easy.

An owners draw account is an equity account in which QuickBooks Desktop tracks withdrawals of the companys assets to pay an owner. This article explains how to set up and process an owners draw account. Pay yourself the right way.

DIY Projects for the Home Hometalk. I am getting a business acct today. An ebook short for electronic book also known as an e-book or eBook is a book publication made available in digital form consisting of text images or both readable on the flat-panel display of computers or other electronic devices.

Accounting Principles - Standalone book 12th Edition by Jerry J. You will pay the owner using an owners draw account. I am a self employed bookkeeper and essentially all of the income earned goes back out to pay personal bills.

Understanding how to leverage social media tools is an important skill to have and a skill that is in high demand. I am trying to figure out how to account for. Weygandt Author Paul D.

The only man in history to complete elite training as a Navy SEAL Army Ranger and Air Force Tactical Air Controller he went on to set records in numerous. But through self-discipline mental toughness and hard work Goggins transformed himself from a depressed overweight young man with no future into a US. I do not have a separate bank account for personal and business.

Lets say your reasonable salary is 60000 and you pay 12000 in health insurance premiums. Kieso Author Free Education for all. You have an owner you want to pay in QuickBooks Desktop.

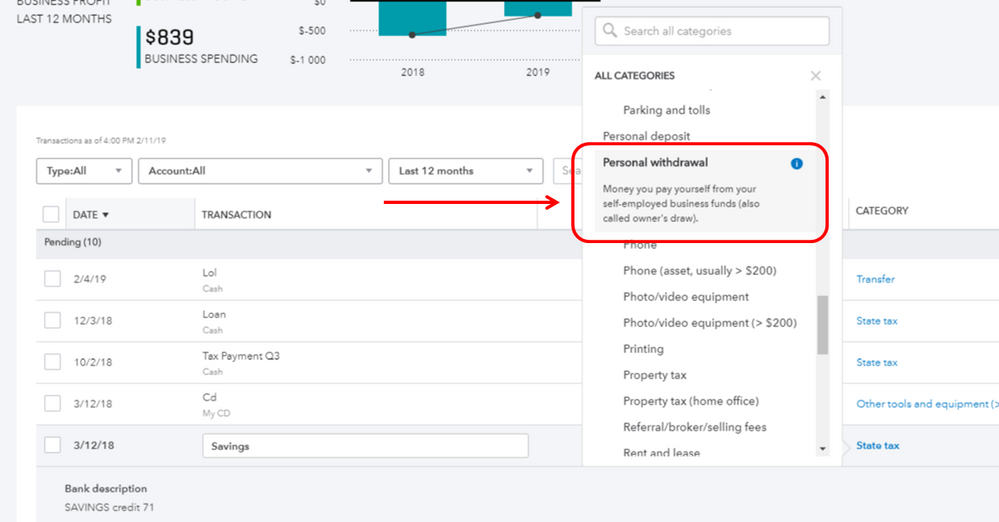

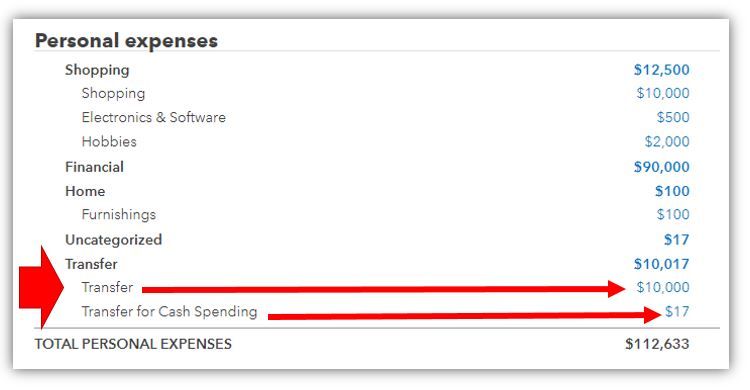

Solved Owner S Draw On Self Employed Qb

Solved Owner S Draw On Self Employed Qb

Expense Tracker Spreadsheet Check More At Https Www Aparsuparjo Com 12279 Expense Tracker S Business Budget Template Business Expense Expense Sheet

Setup A Draw From Quickbooks Self Employed

Quickbooks Self Employed Basics For Business Owners Online Quickbooks Social Media Design Graphics Business Owner

How To Pay Invoices Using Owner S Draw

Quickbooks Self Employed Review 2022 Carefulcents Com Business Tax Small Business Bookkeeping How To Use Quickbooks